With enthusiasm, let’s navigate through the intriguing topic related to Form 202 Texas: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

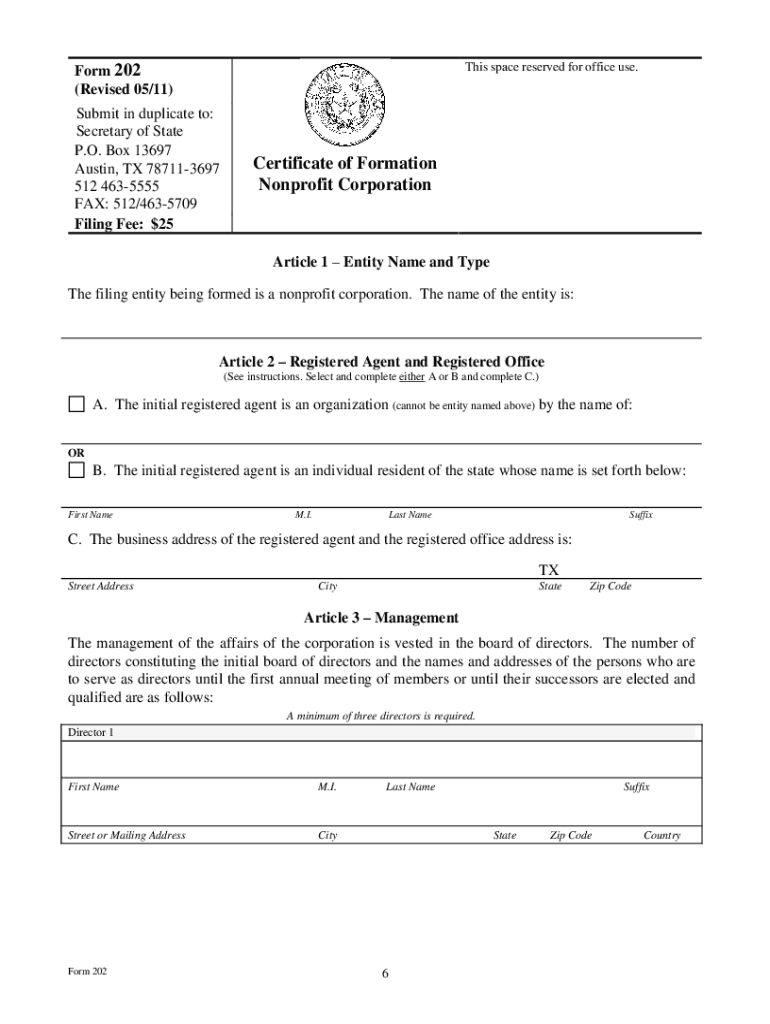

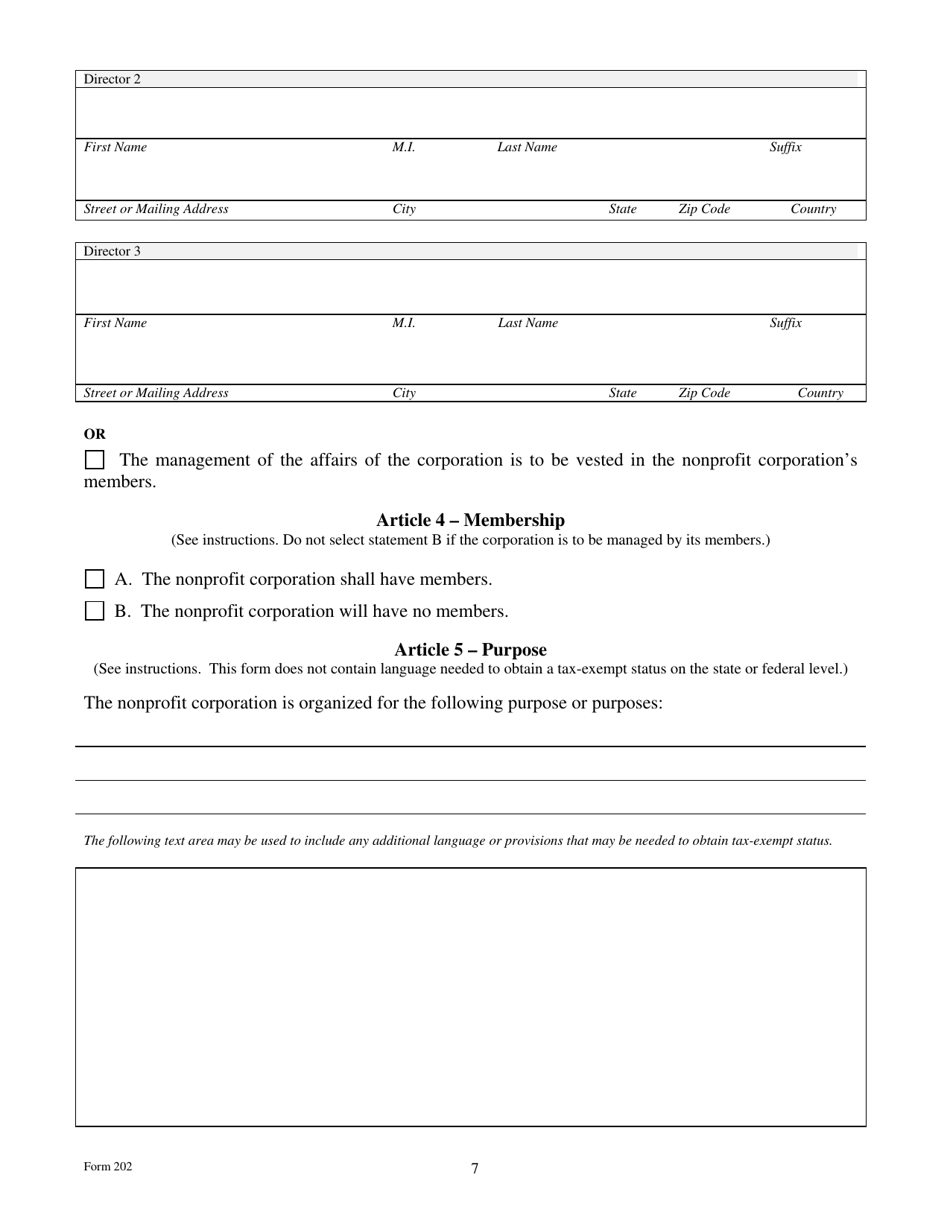

Form 202 Texas, also known as the "Texas Franchise Tax Annual Report," is a crucial document required by the Texas Comptroller of Public Accounts (CPA) from all businesses operating within the state. This report provides vital financial and operational information to the CPA, enabling them to assess and collect franchise taxes from eligible entities. Understanding and accurately completing Form 202 is essential for businesses to fulfill their tax obligations and avoid potential penalties.

All businesses registered or doing business in Texas are required to file Form 202, regardless of whether they have taxable income. This includes:

The deadline for filing Form 202 is May 15th of each year. However, businesses may request an extension until June 15th by submitting Form 202-EXT.

Failure to file Form 202 on time or providing incorrect information can result in penalties and interest charges. Penalties can range from $100 to $1,000, depending on the severity of the offense.

Form 202 Texas is a crucial document that all businesses operating in Texas must complete and file annually. By understanding the requirements, deadlines, and specific instructions for completing Form 202, businesses can ensure compliance with Texas franchise tax laws and avoid potential penalties.

Thus, we hope this article has provided valuable insights into Form 202 Texas: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!